Featured

- Get link

- X

- Other Apps

Property Development Cash Flow Template

Property Development Cash Flow Template. The income articulation reports the measure of money and money reciprocals leaving and entering an organization. This real estate expansion ppt presentation covers wide range of topics like a market snapshot.

It is the net annual cash flow divided by your initial cash investment (thus cash on cash). When you calculate the potential cash flow of a rental property, it can be easy to overestimate income and underestimate expenses. $43,200 (gross rental income) less $2,592 (vacancy factor) less $23,316 (mortgage, taxes, and insurance) less $2,100 (repairs and costs) equals $15,192.

The Cash Flow Relating To The Sale Of The Property Is Not Included In This Calculation.

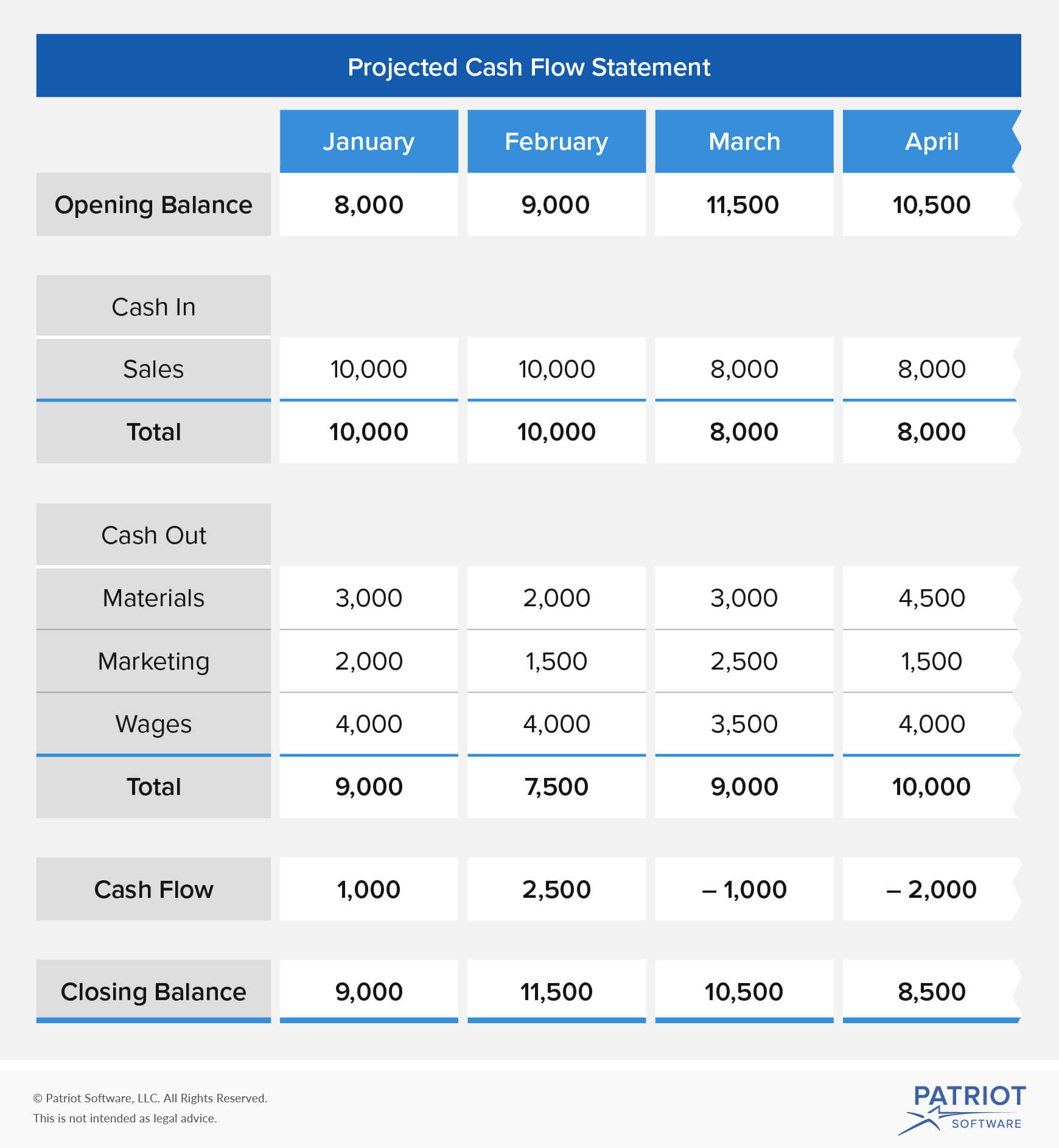

To be notified of other helpful resources for commercial real. Furthermore, it keeps track of all financial cash inflows and outflows for a given period of time. The construction project cash flow spreadsheet template is helpful to manage the cost spend on the clients during the execution of a project.

Our Complete Presentation Slides Are The Perfect Combination Of Expert Subject Matter And Fabulous Designs.

Extra you might also need to enhance your financial model with comprehensive multi family development business plan template. The first step in building a real estate development model is to fill in the assumptions for schedule and property stats. The financial leverage you get from a loan is one of the main purposes of investing in rental property.

Commercial Real Estate Valuation And Financial Feasibility Model.

Investment cashflow is recorded on an organization’s income proclamation. This cash flow calculator helps you establish your annual cash flow (for first year and then subsequent years), based on rental value, minus costs such as mortgage interest, insurance, property management, maintenance, and void periods. Click into a field and help and advice relating to the field will appear here.

These Are The Basic Operational Items That Go Into Cash Flow Calculation.

It is the net annual cash flow divided by your initial cash investment (thus cash on cash). The income is the cash in of the cash flow system and it comes in many forms. This real estate expansion ppt presentation covers wide range of topics like a market snapshot.

This Calculation Is An Important Indicator On Whether A Property Investment Is Cash Flow Positive.

Cash inflows includes cash sales, accounts receivables, loans, tax refund, and other cash receipts. Slideteam provides you predesigned and content ready property development process flowchart powerpoint presentation slides for reference. The first step in the dcf model process is to build a forecast of the three financial statements, based on assumptions about how the business will perform in the future.

Popular Posts

Avatar Property And Casualty Insurance Company Tampa Fl 33602

- Get link

- X

- Other Apps

Comments

Post a Comment